Washington Co., WI – If you just can’t wait to get your 2020 property tax bill you can check it online. Most of the 2020 property tax bills have been posted.

The remainder of the communities will be added this coming week and then it’s up to the individual municipality to put them in the mail.

As of December 5, tax bills are available for the following municipalities:

CITY OF WEST BEND

VILLAGES OF GERMANTOWN AND SLINGER,

TOWNSHIPS OF ADDISON, BARTON, ERIN, FARMINGTON, GERMANTOWN, TRENTON, KEWASKUM

The tax bill is the aggregate amount levied by several taxing bodies, such as county, municipality (Township, Village, City), school district, technical college, etc.

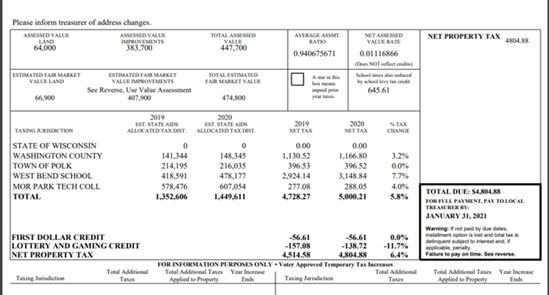

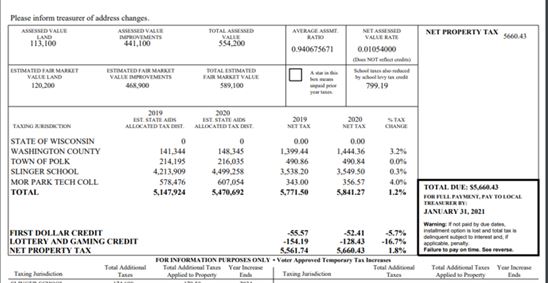

Two numbers to watch are your Net Property Tax (what you will pay out of pocket) and Total Estimated Fair Market Value (the amount that the mill rate is applied to.)

More analysis of the net tax impact of adjustments to Total Estimated Fair Market Value will be discussed after all municipality tax bills have been uploaded.

While much has been made of flat or declining mill rates (amount levied per $1,000 of property value), in some cases taxpayers may experience a net increase, because Total Assessed Value has been divided by an Average Assessment Ratio that reflects real estate sale price increases in your municipality in the year 2019.

Click HERE to get to the statement and then scroll down and click on Washington County Tax Inquiry Program or follow the steps below.

If you click on the link, the County Treasurer’s office said “less is more” with the amount of information you tap in. Simply type in your last name and your statement should come up.

Couple details to look for:

– The ‘first dollar credit’ is $56.61. That’s the same as 2019 and an increase from $55.80 in 2018. This amount will vary depending on your municipality.

– The ‘lottery and gaming credit’ is down 11.7%. This year the credit is $138.72 which is down from $157.08 in 2019, $135.51 in 2018 and $97 in 2017. This amount will vary depending on your municipality.

City of West Bend home: 2.8% increase before credits. Credits less this year, so actual net increase is 3.4%

– In West Bend the common council voted to increase taxes by 7.94% which is 7-cents more than in 2019 raising the mill rate to $7.93 per 1,000. The change on the tax bill reads it is up 1.0%.

– The Washington County tax is up 1.4%. The amount may be different depending on your municipality.

– In the West Bend School District the tax is up 5.3%. The amount taxed in the district may be different depending on your municipality.

-Town of Wayne tax bill to see Kewaskum School District. 12.5% decrease.

-In the Slinger School District the tax rate is up 0.0%

0.6% increase before credits. Credits less this year, so actual net increase is 1.3%. Slinger School District up 0.0%. Estimated Fair Market Value up 5.6%

Neighboring school district example:

The “mill rate” is the charge per $1,000 of property value. If the Estimated Fair Market Value has gone up, the amount of increase gets divided by 1,000. That amount multiplied by the mill rate becomes additional tax.

Bad analogy would be if your car tank holds 20 gallons. After a trip, you go to fill up and buy 15 gallons at $2.00. Next time you take that trip, there are a bunch of detours that add to the number of miles traveled. You come back and gas is still $2.00 a gallon. Good news, cost of gas per gallon remains flat – no increase. But now the car needs 17 gallons to fill up. In that scenario you are paying more.

REAL EXAMPLE: There are two houses at the border of West Bend and Slinger School districts. Across the road from each other. Note – the Fair Market values are different, so ignore the dollar amounts. Pay attention to the Per Centages.

Slinger School District. 1.8% increase. Last year the increase was 2.1%. Dollar tax increase over 2 years = $211.

Now look at the West Bend School District house on Pleasant Valley Road – right across the road from the Slinger house. 6.4% increase. Last year the increase was 6.2%. Dollar tax increase over 2 years = $555. And the market value of that house is $114,300 less.