Richfield, WI – Village residents have until January 31, 2022, to get their tax payments into the Village Hall. Residents have the option to pay property taxes in-person at Village Hall, located at 4128 Hubertus Road, Richfield, WI, or at Landmark Credit Union, located at 3098 Reflections Drive, Hubertus, WI.

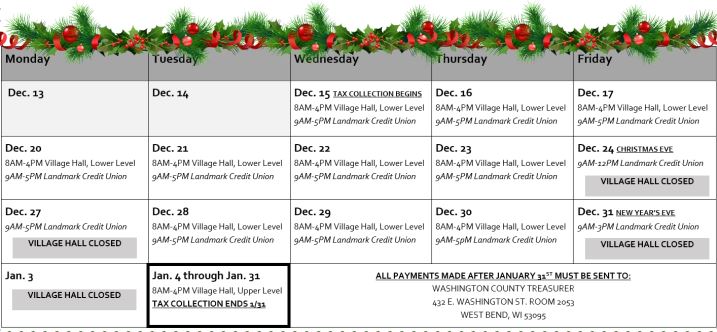

The dates and times that in-person payments will be accepted and at what location are listed in the following calendar.

Other ways you can make your total payment or first installment payment of your taxes before January 31, 2022.

1. Pay by Mail: Please send payments to the Village of Richfield, c/o Attn. Treasurer, 4128 Hubertus Road, Hubertus, WI 53033. Make checks payable to the “Village of Richfield” and include a contact phone number in the memo section. Payments must be postmarked on or before the due date to be considered timely. There is a $30 charge for returned checks and payment will be void. Send a self-addressed, stamped envelope if you would like a receipt, and allow 10—15 business days to receive a receipt. Checks issued by lenders must be endorsed by all parties listed as the payee.

2. Payment Drop-off: Payments can be dropped off in our secured deposit box located to the left of the entrance to Village Hall. Please follow the Pay by Mail instructions included with your tax bill. Payments are collected from the deposit box each business day.

3. Pay In-person: Payments can also be made inside or via drive-thru at Landmark Credit Union located at 3098 Reflections Drive, Hubertus, WI. Landmark Credit Union requires non-vaccinated individuals to wear a face-covering when in the lobby and vaccinated individuals are strongly encouraged to also wear a face covering. Dates and times of

collection at Landmark Credit Union are also listed on page 4 as ‘LCU’. Payments will not be processed on weekends at either location.

4. Online or phone payments: Go to www.richfieldwi.gov, click on the Online Payments button, then select “Taxes”. Choose “Local Payments”. Then, under “Payment Type” select either “Real Estate Tax” or “Personal Property Tax”. Real Estate Property Taxes are for land property payments and Personal Property Taxes are for business property payments. Acceptable forms of payment include credit cards or electronic checks. For phone

payments, call 1-800-272-9829 and follow the prompts of the operator. Please note there are charges associated with making payments online or over the phone.

*Individuals paying for both dog licenses and taxes must issue two (2) separate forms of payment