Washington Co., WI – Having Flash Flood insurance* is one more way you can prepare for the unexpected. Flooding can happen even if you aren’t located near a river, lake or ocean. In fact, a high percentage of flooding in the United States occurs in areas that aren’t near bodies of water. As a homeowner, it’s a good idea to have flood insurance to protect your home, even if you don’t live in a flood zone.

If my home is flooded, won’t federal disaster assistance pay for my damages?

Not necessarily. There must be a federal disaster declaration where the property is located and then you must apply for assistance. If granted, disaster assistance doesn’t typically cover all the damage. And in most cases, the assistance is a loan that needs to be paid back in full.

Will Flash Flood coverage satisfy flood coverage requirements from my lender?

No, Flash Flood coverage does not meet the minimum requirements for mandated flood coverage from your lender. Your agent is the perfect resource to help you find the appropriate coverage that meets the requirements.

What does Flash Flood insurance cover?

Flash Flood insurance may help cover your dwelling, other structures on the property, personal property (including personal property in your basement), additional living expenses, fair rental value, property moved to another location for safety and the cost of

debris removal. An agent can help you understand available coverage limits and limitations.

What does Flash Flood insurance cover?

Flash Flood insurance may help cover your dwelling, other structures on the property, personal property (including personal property in your basement), additional living expenses, fair rental value, property moved to another location for safety and the cost of

debris removal. An agent can help you understand available coverage limits and limitations.

What type of events does Flash Flood coverage protect me from?

Flash Flood insurance may cover flood losses from any water source such as overflow of lakes, rivers, streams, tidal waters, rainfall, ice melt, mudflow, lawn/garden sprinkler systems, garden hoses, spigots, hydrants, swimming pools or hot tubs.

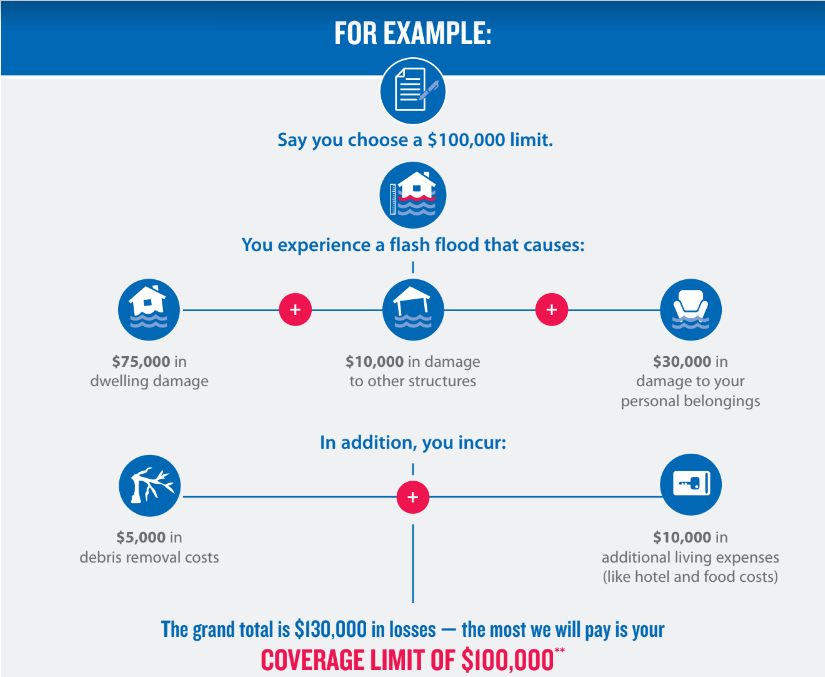

What limits are available for Flash Flood coverage?

Homeowner policyholders can select from limits of $25,000, $50,000 and $100,000. If you have a renters or condo policy, your limit options are $10,000 and $25,000. Limit availability may vary based on your location.

Is the Flash Flood coverage limit for my dwelling or contents?

The coverage limit is the total amount we would pay for a loss, whether the damage was to your dwelling or personal property.

This limit also covers costs for things like additional living expenses while your home is being repaired or rebuilt, as well as the costs for debris removal and moving personal property to safety.

For example:

Does my homeowner’s policy cover flood damage?

Unfortunately, it probably doesn’t. The good news is that there are multiple options available to financially protect your home from flood damage. A good place to start?

Your agent can help you find flood coverage that fits your needs.

My team is here to serve. Our unique backgrounds, training and experience have prepared us well to help meet your insurance needs. Additionally, as residents of your community, we understand how important it is to be there for you – our trusted friends and neighbors. Together, we’re building strong partnerships that help everyone succeed. Click HERE for more information.