During Monday night’s West Bend Common Council meeting aldermen approved sending a resolution to elected officials in Madison regarding a tax loopholes used by big box stores use to challenge their property tax assessments.

In West Bend the Walgreens stories filed a lawsuit regarding its assessments from 2012-2014.

Both cases were settled in 2015 which included a reduction of the 2015 assessment and a tax reimbursement. That settlement resulted in a loss of $159,980 in tax revenues for the City of West Bend.

Here’s a Cliff Notes version of the Assessor’ office resolution proposal.

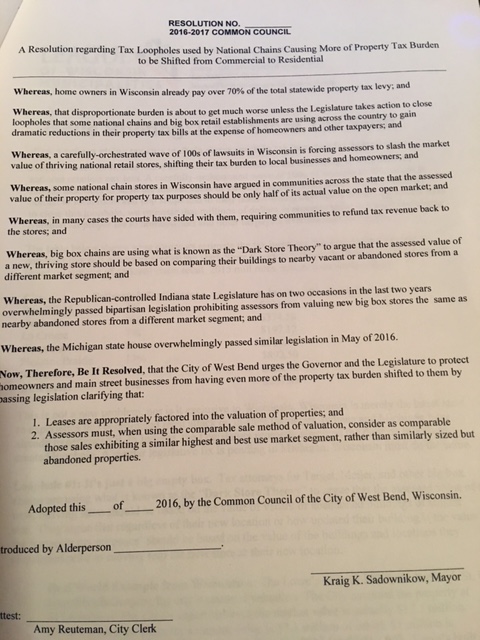

A resolution regarding tax loopholes used by national chains causing more of property tax burden to be shifted from Commercial Residential. This proposal is urging the Governor and Legislature to protect homeowners and Main Street businesses from having even more of the property tax burden shifted to them to clarify that:

- Leases are appropriately factored into the valuation of properties; and

- Assessors must, when using the comparable sale method of valuation, consider as comparable those sales exhibiting a similar highest and beat use market segment, rather than similarly sized but abandon properties.

The league of Wisconsin is proposing law changes that will address this very concerning issue closing tax loopholes.

Aside from Walgreens appealing its assessment the ShopKo in West Bend also appealed as did Menards on Paradise Drive.

The city agreed to let the Governor and lawmakers know the passage of legislation is necessary to clarify:

- Leases are appropriately factored into the valuation of properties: and

- Assessors must, when using the comparable sale method of valuation, consider as comparable those sales exhibiting a similar highest and best-use market segment, rather that similarly sized but abandoned properties.

If you take a look at the history of the Walgreens property, 1921 S. Main Street

Nov. 15, 2011 the property sold for $5.7 million

2014 assessment was for the $5.7 million

2015 assessment was for $2.4 million (a 57% reduction)

January 26, 2016 the property sold for $7 million